This article may contain affiliate links. See our disclaimer for more information.

In this article, I will explore an important decision many people face – whether to pay off debt or save for their future. It can be challenging to determine which to prioritize. With the right strategies and methods, it is possible to make the best financial choices for a secure and debt-free future.

There are many factors to consider when determining whether you should pay off debt or save. Things like interest rates, your financial goals, and how much time you have to accomplish these goals all affect which strategy you should consider.

Before making a decision, it’s crucial to assess your current debt situation. I will discuss effective debt reduction strategies, debt management tips, and explore options such as debt consolidation. Understanding your debts is the first step towards financial freedom.

Saving money plays an important role in securing your future, and I will provide practical tips on how to save money, including strategies to save from your salary and ways to cut expenses. Building savings is an essential step towards financial stability.

In this article, I will also delve into different debt repayment options, such as the debt snowball or using a debt payoff calendar. Evaluating the best approach will help you make progress towards becoming debt-free.

While paying off debt has numerous benefits, including reducing financial stress and improving your credit score, saving for the future is also essential to ensure long-term financial security. We will touch on the importance of saving, including emergency funds, retirement planning, and other financial goals.

It is possible to strike a balance between debt payoff and saving. I will explore strategies that allow you to prioritize both simultaneously, including budgeting strategies and ways to increase your income. This includes some practical tips to help you save more efficiently and make the most of your income.

Sometimes, seeking professional advice can be beneficial in managing your debt and savings. I will explore the importance of financial planning and the potential benefits of consulting with a financial advisor.

Armed with knowledge and understanding, you’ll be able to make an informed decision on whether to prioritize debt payoff or savings, taking into account your personal financial goals and circumstances.

Achieving financial freedom and living debt-free is an exciting prospect, but sometimes your priority must be saving your money instead. You will face many obstacles in your financial journey, but I’ll do my best to get you on the right path to success.

Choosing whether to pay off debt or save is a personal decision that depends on your unique circumstances. By utilizing the strategies and tips discussed throughout this article, you can work towards both debt reduction and building savings to secure a financially sound future. Remember, it’s important to evaluate your priorities and make informed decisions that align with your financial goals.

Understanding Your Debt Situation

Before deciding whether to prioritize to pay off debt or save for the future, it’s essential to understand your current debt situation. Effective debt reduction strategies and debt management tips can help put you on the path to financial freedom. Additionally, exploring debt consolidation options and seeking financial planning advice can provide valuable insight into how to best manage your debts.

By taking these steps, you can gain a better understanding of your current debt situation and create a plan to start reducing it. Personal finance tips can also help guide you towards making smart financial decisions to improve your overall financial health.

The Importance of Building Savings

Building savings is also a crucial part of securing your future. It provides a safety net for unexpected expenses or emergencies and helps you reach your financial goals. Here are some tips on how to save money and build your savings:

- Set a budget: Creating a budget is the first step in saving money. It helps you track your expenses and identify areas where you can cut back. Start by listing your income and all of your expenses, and then allocate a portion of your income towards savings.

- Save from your salary: One effective way to save money is to set up an automatic transfer from your checking account to your savings account each payday. This ensures that you save a fixed amount each month, which can quickly add up over time.

- Reduce your expenses: Look for ways to cut back on your expenses, such as buying generic brands, cooking at home more often, or using coupons and promo codes when shopping online.

- Get a side hustle: Consider taking on a part-time job or freelancing to increase your income and boost your savings.

When building your savings, it’s important to set realistic goals. Start small and gradually increase your savings contributions over time. Remember, every little bit helps, so even saving a few dollars a week can make a big difference in the long run.

Analyzing Debt Repayment Options

Let’s head back to debt for a minute. You should now have a clear understanding of your debt situation, it’s time to explore different debt repayment options. When it comes to paying off debt, there is no one-size-fits-all solution. What works for one person might not work for another. That being said, there are some popular debt payoff methods that have been proven to be effective.

Debt Snowball

The debt snowball method involves prioritizing your debts from the smallest to the largest balance. You make the minimum payment on all of your debts except the smallest, which you pay off as quickly as possible. Once that debt is paid off, you move on to the next smallest and so on. This method helps build momentum and motivation as you see progress with each debt paid off.

Debt Payoff Calendar

A debt payoff calendar is a visual representation of your debt repayment plan. You can create one using a spreadsheet or simply on a piece of paper. List all of your debts and their balances, and then create a schedule for paying them off. As you make payments, mark them off on the calendar. This method helps you stay accountable and motivated to stick to your plan.

Debt Payoff Tracker

This is one of my favorite methods, and it’s mostly just a visual motivation to pay off debt. With this method you can buy or create a tracker that helps you keep track of your pay down amount. Each time you pay off a certain amount you can fill in another section on the tracker. It can be very fulfilling and encouraging to fill in another section, which will help keep you motivated to pay that debt off!

Debt Avalanche Method

There are other debt payoff methods, such as the debt avalanche method, which prioritizes debts with the highest interest rates first. Put your debts in order from highest interest rate to lowest interest rate and put any extra money you can to the highest one. Then pay that debt down. Once it’s gone, pay the next one and so forth. This will ultimately save you money as you will pay less on interest over time.

The key is to find a method that works for you and stick to it. Remember, the goal is to pay off your debt as quickly and efficiently as possible.

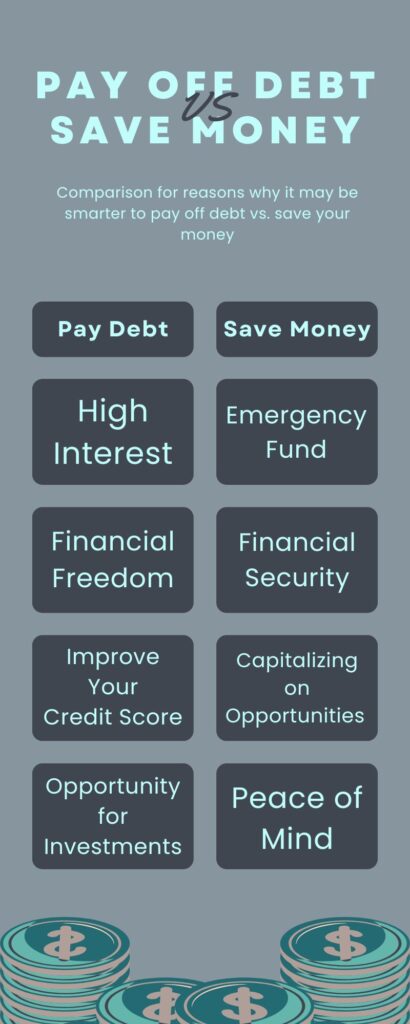

Let’s start to dive into some reasons why it might be better to pay off debt or save your money.

Weighing the Benefits of Paying off Debt

When it comes to choosing whether to pay off debt or save, there are obvious benefits to both. But when considering which option to prioritize, it’s important to understand the advantages of paying off debt.

- Pay off debt vs savings: While saving for the future is important, high-interest debt can be a considerable burden on your finances. By prioritizing debt repayment, you can reduce your financial stress and improve your credit score, putting you in a better position to save in the long run.

- Debt reduction strategies: By focusing on paying off debt, you can utilize various debt reduction strategies to accelerate your progress. Methods such as the debt snowball and debt payoff calendar can help you pay off debt fast and efficiently.

- Financial planning: Prioritizing debt repayment is a crucial component of any solid financial plan. By reducing your debt, you can increase your disposable income, allowing you to allocate more towards saving and investing.

- Debt-free living: Finally, the ultimate benefit of paying off debt is achieving debt-free living. This means having the financial freedom to pursue your goals, without the stress and worry of debt hanging over your head. It’s a worthy goal, and prioritizing debt repayment is a great way to achieve it.

The Importance of Building Savings

When it comes to achieving financial security, building savings is an essential step. By saving money regularly, you can create a safety net for unexpected expenses, achieve major financial goals like buying a home or planning for retirement, and ultimately pave the way towards a debt-free future.

So, how can you start building your savings? Here are some save money tips to help you get started:

- Create a budget: To save money, you need to know where your money is going. Create a budget to track your expenses and identify areas where you can cut back.

- Set savings goals: Whether it’s a down payment on a house or an emergency fund, setting specific savings goals can help motivate you to save regularly.

- Automate your savings: One of the easiest ways to save money is to automate the process. Set up automatic transfers from your checking account to your savings account each month.

- Reduce expenses: Look for ways to cut back on your expenses, such as canceling subscription services you don’t use or eating out less often.

- Increase your income: Consider taking on a side hustle or asking for a raise at work to increase your income and have more money to put towards savings.

Looking for more savings tips? Check out our article here.

It’s important to note that building savings is not a one-time event, but an ongoing process. By consistently saving a portion of your income each month and following these saving money tips, you can gradually build up a strong financial foundation for yourself and your family.

Saving Money Tips:

- Building Savings

- Financial Planning

- Create a budget

- Automate your savings

- Set savings goals

- Reduce expenses

- Increase your income

Prioritizing Debt Payoff and Savings Simultaneously

When deciding between paying off debt or saving for the future, it’s important to understand that it’s possible to utilize a hybrid method and do both simultaneously. Prioritizing debt payoff and savings requires careful planning and a clear understanding of your financial situation.

Debt Reduction Strategies: To effectively manage your debt while building your savings, consider implementing some of the debt reduction strategies we discussed above such as the snowball and avalanche methods. You may also want to consider debt consolidation or speaking with a financial advisor to explore additional options.

Saving Money Tips: In addition to debt reduction strategies, there are various ways to save money while paying off your debts. Create a budget that allows for both debt payments and savings contributions. Look for ways to cut expenses, such as reducing your utility bills or cutting back on eating out. Consider increasing your income by taking on a part-time job or starting a side hustle.

Financial Planning: To effectively balance debt payoff and savings contributions, it’s essential to have a solid financial plan. Consider creating a comprehensive budget that takes into account all of your expenses and sources of income. Set clear financial goals and establish a timeline to achieve them. Make sure to regularly review and update your financial plan as needed.

Budget Strategies: Budgeting is a crucial aspect of prioritizing debt payoff and savings. When creating your budget, be sure to allocate a portion of your income towards both debt payments and savings contributions. Consider using budgeting apps or tools to effectively manage your finances and stay on track towards your goals.

Here are some steps you can take:

- Allocate a portion of your income towards debt payments and savings contributions

- Create a comprehensive budget that takes into account all of your expenses and sources of income

- Set clear financial goals and establish a timeline to achieve them

- Regularly review and update your financial plan

- Use budgeting apps or tools to manage your finances effectively

By utilizing debt reduction strategies, saving money tips, financial planning, and budget strategies, you can effectively prioritize both debt payoff and savings contributions. Remember to stay motivated and disciplined in your approach, and you’ll be on your way to achieving your financial goals in no time.

Maximizing Debt Reduction

When it comes to debt reduction strategies, there are several methods to consider. While we’ve discussed the debt snowball and debt payoff calendar options in a previous section, there are additional approaches to maximize your debt reduction efforts.

Debt Reduction Strategies

- Balance Transfer – A balance transfer involves moving high-interest credit card debt to a new card with a lower interest rate. This allows you to pay less interest and reduce your debt more quickly.

- Debt Settlement – Debt settlement involves negotiating with creditors to pay off debt for a lower amount than what is owed. While this can be effective, it can also have a negative impact on your credit score.

It’s important to evaluate each strategy and choose the one that will work best for your unique situation. Remember to consider the potential impact on your credit score and overall financial well-being. A financial advisor can also provide helpful insight and guidance.

In addition to these strategies, it’s crucial to practice good financial habits to keep your debt reduction efforts on track. This includes budgeting effectively, avoiding unnecessary expenses, and seeking opportunities to increase your income.

By maximizing your debt reduction efforts, you can accelerate your progress towards becoming debt-free and achieving financial freedom.

Strategies to Boost Savings

Building savings is an essential part of achieving financial stability and securing your future. However, it can be challenging to save money, especially when you have bills to pay and a limited income. Here’s a more in depth look at ways to save more efficiently:

- Create a budget: Knowing how much money you have coming in and going out can help you identify areas where you can cut back and save more.

- Set saving goals: Determine how much money you want to save and by when. Having a specific goal in mind can motivate you to save more consistently.

- Automate savings: Set up automatic transfers to a separate savings account each month. This way, you won’t have to actively think about saving and the money will be out of sight, out of mind.

- Cut expenses: Look for ways to reduce your monthly expenses, such as canceling subscriptions or negotiating bills. The money you save can be put towards your savings goals.

- Save from your salary: Allocate a percentage of your salary towards savings each month. Even if it’s a small amount, it can add up over time.

- Take advantage of discounts and coupons: Look for deals and coupons when shopping for necessities. This can help you save money and increase your overall buying power.

By implementing these strategies, you can significantly boost your savings and make progress towards your financial goals.

Seeking Professional Advice

While managing your debt and savings can seem overwhelming, seeking professional advice can help you make informed decisions and create a solid financial plan. A financial advisor can assist you in analyzing your debts and expenses, developing a budget, and exploring debt consolidation options. They can also help you make the decision of whether to pay off debt or save your money.

Financial planning is essential in creating a roadmap for achieving your financial goals. Working with a professional can provide you with personalized strategies and insights to help you make the most of your income and savings. They can also provide tips on how to save money, invest wisely, and plan for your retirement.

When considering seeking professional advice, it’s important to research and choose a qualified and experienced advisor. Look for advisors with relevant certifications and credentials, and read online reviews and testimonials from their clients. You can also ask for recommendations from friends or family members.

Benefits of Seeking Professional Advice

- Debt Consolidation Options

- Personalized financial strategies

- Expert insights and advice

- Assistance in creating a budget

- Recommendations for savings and investment opportunities

- Long-term financial planning guidance

- Credit counseling

- Debt management programs

- Debt consolidation loans

- Home equity loans or lines of credit

- Balance transfer credit cards

Remember, seeking professional advice is a valuable investment in your future financial security. Don’t hesitate to reach out to a financial advisor to explore options and receive personalized assistance in managing your debt and savings.

Disclaimer: The information provided in this article is for educational purposes only and does not constitute financial advice. Please consult with a qualified financial advisor before making any financial decisions.

Making an Informed Decision

After examining all the options and considering your personal financial goals and situation, you’re now ready to make an informed decision on whether to prioritize to pay off debt or save. Keep in mind that there is no one-size-fits-all answer, and what works for one person may not work for another.

If you have high-interest debt, such as credit card debt, it’s generally recommended to prioritize debt reduction to avoid accruing more interest. Consider using debt reduction strategies like the debt snowball or debt avalanche method to pay off your debts efficiently.

At the same time, it’s important to build up savings to prepare for unexpected expenses and work towards your long-term financial goals. Using saving money tips like creating a budget, cutting expenses, and increasing your income can help you build up your savings.

It’s also important to consider seeking personal finance tips and financial planning advice to help you make the best decision for your unique situation. Consulting with a financial advisor or debt counselor may be beneficial in helping you navigate your options and make an informed decision. If you can’t decide if you should pay off debt or save your money, I strongly recommend seeking help.

Remember, the key is to evaluate your priorities and make a decision that aligns with your financial goals. With the right debt reduction strategies and saving money tips, you can work towards both goals and achieve a financially secure future.

Finding Motivation and Staying on Track

When it comes to paying off debt and building savings, it’s essential to stay motivated and committed to your goals. As you make progress towards your goals, take some time to celebrate your achievements. This can help you stay motivated and focused on your financial journey. Treat yourself to a small reward or indulge in a favorite activity.

It’s also essential to manage your debts effectively and prioritize your budget. Here are some debt management tips to keep in mind:

- Keep Track of Due Dates: Late payments can lead to additional fees and damage to your credit score. Make sure to keep track of your due dates and pay your bills on time.

- Negotiate with Creditors: If you’re struggling to make ends meet, consider reaching out to your creditors to see if they can offer any assistance. This could involve negotiating a payment plan or seeking a settlement offer.

- Consider Debt Consolidation: Debt consolidation involves combining multiple debts into one loan with a lower interest rate. This can make it easier to manage your debts and save money on interest payments.

As you know, saving money is a crucial part of achieving financial freedom. Here are some tips to help you save money:

- Set Up Automatic Savings: Many banks offer the option to set up automatic transfers from your checking account to your savings account. This can help you save money without thinking about it.

- Brown Bag Your Lunch: Bringing your lunch to work instead of eating out can save you a significant amount of money each week.

- Cut Back on Unnecessary Expenses: Take a close look at your expenses and identify areas where you can cut back. This could involve canceling subscriptions you don’t use or reducing your entertainment budget.

By staying motivated, managing your debts effectively, and saving money where you can, you’ll be able to make consistent progress towards your financial goals. Sometimes you don’t have to choose whether you can pay off debt or save, you can do both! Remember, achieving financial freedom takes time and dedication, but the rewards are well worth the effort.

Overcoming Obstacles and Challenges

When it comes to managing your debt and savings, challenges and obstacles are inevitable. Here are some strategies to help you overcome them:

- Stay disciplined: It can be tempting to deviate from your budget or savings plan, but staying disciplined is key to achieving your financial goals. Consider setting up automatic payments to ensure bills are paid on time and automate your savings so you don’t have to actively transfer money each month.

- Utilize debt reduction strategies: If you’re struggling to make progress on your debts, consider exploring different debt reduction strategies, such as the debt snowball or debt avalanche methods. Look for opportunities to increase your income, whether it’s through a side hustle or negotiating a raise with your employer.

- Reassess your financial goals: If you find that your current financial goals are unrealistic or too challenging, it may be time to reassess and adjust them. Make sure your goals are specific, measurable, and achievable.

- Seek professional guidance: Consider consulting with a financial planner or advisor for personalized advice on debt reduction strategies, budgeting, and financial planning. They can also provide support and accountability to help you stay on track and motivated.

Remember, overcoming obstacles and challenges is a natural part of the journey towards financial freedom. By staying disciplined, reassessing your goals, and seeking professional guidance, you can overcome any challenges that come your way and achieve your desired financial outcome. Once you overcome these goals, it can be an easier decision of whether to pay off debt or save. The choice will be yours.

Celebrating Milestones along the Way

As you work towards your financial goals, it’s important to recognize and celebrate milestones. Whether it’s paying off a significant amount of debt or reaching a savings target, milestones help you stay motivated and acknowledge your progress. Here are some ways to celebrate your achievements:

- Share your success with friends and family – they’ll be happy to celebrate with you!

- Treat yourself to a small, budget-friendly reward, like a special meal or a movie night.

- Take a moment to reflect on how far you’ve come and congratulate yourself.

Celebrating milestones is an essential part of staying motivated and committed to your financial goals. Remember, progress is progress, no matter how small. Keep up the good work!

Here are some inspirational ideas to help keep you motivated!

| Milestone | How to Celebrate |

| Pay off a credit card | Treat yourself to a special meal or desert |

| Reach a savings goal | Take a day trip to a nearby attraction |

| Reduce overall debt by significant amount | Plan a fun activity like a picnic or hike |

Celebrating milestones isn’t just about the event itself, but also about recognizing your hard work and dedication. It’s important to embrace the journey and appreciate the progress you’ve made along the way. Keep going, and remember that each step takes you closer to achieving your financial dreams.

Embracing a Debt-Free Future

As you decide if you should pay off debt or save, you may choose a debt-free lifestyle. Living a debt-free life is a liberating experience that brings peace of mind. It requires discipline and commitment, but the rewards are well worth the effort. Here are some personal finance tips and financial planning strategies to help you embrace a debt-free future.

- Evaluate Your Financial Goals – Start by reviewing your financial goals, both short-term and long-term. Identify where you can cut back expenses and prioritize debt repayment. Create a budget that works for you and helps you achieve your goals.

- Track Your Spending – Tracking your spending is a vital step in managing your finances. It helps you identify where your money is going and where you can make changes. Use a spreadsheet, a budgeting app, or online tools to help you monitor your expenses.

- Build an Emergency Fund – Establishing an emergency fund is crucial in maintaining financial stability. It helps you handle unexpected expenses without relying on credit cards or loans. Aim to save at least three to six months’ worth of expenses.

- Prioritize Debt Repayment – Debt repayment should be a top priority in achieving a debt-free future. Utilize debt reduction strategies, such as the debt snowball or debt avalanche method, to tackle your debts systematically. Understand your debt consolidation options and determine the best approach for your situation.

- Invest in Your Future – Investing in your future is vital for long-term financial security. Consider opening a retirement account or investing in the stock market. Educate yourself on investing and seek professional advice if necessary.

- Celebrate Milestones – As we discussed, celebrating your milestones can help keep you motivated on your financial journey. Reward yourself for achieving your goals, while staying focused on the bigger picture. It’s important to maintain motivation and continue striving towards financial freedom.

Becoming debt-free is a journey that requires patience, dedication, and hard work. Use these personal finance tips and financial planning strategies to help you embrace a debt-free future. Remember, every step you take brings you closer to financial freedom.

Conclusion

As I wrap up this article, I hope it has provided you with valuable insights into the important decision of whether to pay off debt or save for the future. Remember, it’s crucial to have a solid understanding of your debt situation, explore effective debt reduction strategies, and prioritize building savings.

While it may seem overwhelming at first, approaching your finances with a plan, seeking professional advice when necessary, and staying motivated can help you achieve your financial goals.

Whether you choose to prioritize debt payoff or savings, it’s important to make informed decisions that align with your financial priorities and goals. Utilizing the strategies and tips discussed in this article, you can work towards a debt-free and financially secure future.

Thank you for reading and remember, with careful planning and dedication, financial freedom is within reach.