This article may contain affiliate links. See our disclaimer for more information.

According to a survey by theGOBankingRate, 38% of adults in the US have less than $100 in their checking accounts and 36% have less than $100 in their savings. Saving money on a low income might seem challenging, but it’s not impossible. I’ve been there. For a period of time I was earning with only a part time income. I wanted to see my savings grow, but it seemed impossible. But it’s not.

Down below we have plenty of practical tips and strategies on how to save money fast on a low income. Whether you’re trying to build an emergency fund, save for a big expense, or looking to save that extra $1000, we’ve got you covered.

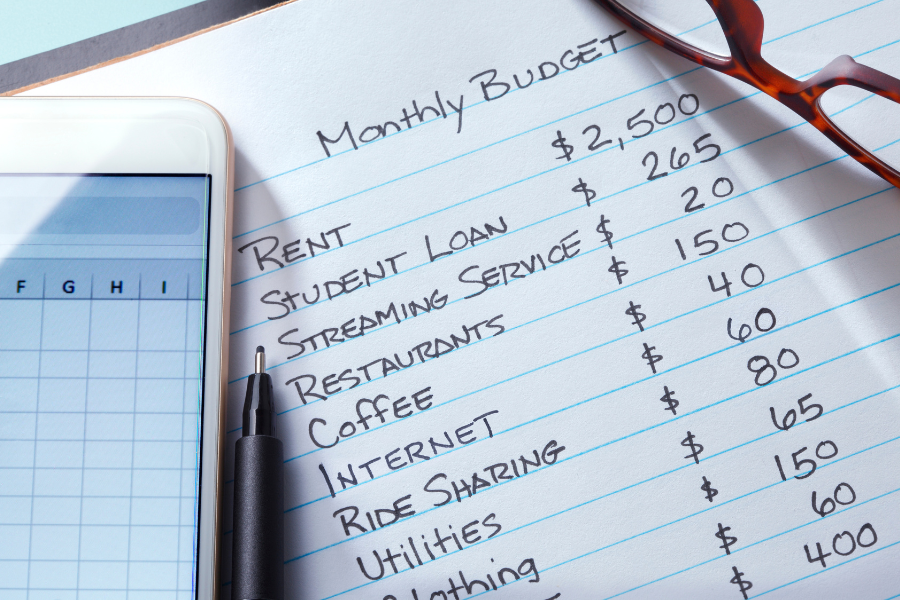

Create a Budget

Setting a budget is an essential step in saving money, regardless of your income level. By creating a budget, you can gain better control over your finances and make informed decisions about your spending habits. Here are some budget strategies to help you get started:

- 70-20-10 Budget Rule: One popular budgeting strategy is the 70-20-10 rule. This rule suggests that you allocate 70% of your post-tax income towards essential expenses, such as housing, utilities, and groceries. Dedicate 20% towards savings and investments, which can include building an emergency fund or contributing to retirement accounts. The remaining 10% can be allocated towards extra debt payments or charitable donations.

- Expense Categorization: To better track your spending, list your expenses and categorize them as necessary or unnecessary items. Necessary expenses are essential for your daily living, such as rent, utilities, and food. Unnecessary expenses may include entertainment, dining out, or impulse purchases. By identifying these categories, you can prioritize your spending and make adjustments where necessary.

Creating a budget not only helps you save money but also gives you a clear picture of where your money is going. It allows you to make intentional financial decisions that align with your goals and priorities.

For more budget tips, check out our article Budgeting Help for Newbies.

Open a Savings Account

Putting money into a savings account is a key step in your journey to save money fast, especially if you’re working with a low income. Whether you choose a traditional savings account or a high-yield savings account, the benefits are numerous.

A traditional savings account typically offers an average annual percentage yield (APY) of around 0.42%. While this may seem low, it still provides a safe place to store your money and earn some interest over time. On the other hand, a high-yield savings account offers a more attractive APY, ranging from 5% to 7%.

Having a savings account not only shields your money but also enables it to grow through interest. This can be a powerful tool to help you achieve your savings goals faster. I have never saved more money than when I kept my savings in their own, separate account from my other money.

In fact, I now have multiple different accounts for different savings goals just to help keep my savings growing.

If you’re considering opening a savings account, it’s essential to compare different options to find the one that best suits your needs. Look for features such as low fees, convenient access to your funds, and a reputable financial institution.

Benefits of a Savings Account:

- Safe and Secure: Your money is protected by the Federal Deposit Insurance Corporation (FDIC) up to $250,000.

- Easy Access: Most savings accounts allow you to withdraw money whenever you need it.

- Earn Interest: While the interest rates may vary, even a modest APY can help your savings grow over time.

- Financial Goal Tracking: Separating your savings from your checking account can make it easier to track your progress towards your financial goals.

- Cultivate a Savings Habit: By regularly depositing into your savings account, you can develop a routine of saving money that becomes second nature.

The key to maximizing the benefits of a savings account is to consistently make deposits and resist the temptation to withdraw money for non-essential purposes. By doing so, you can take advantage of the interest earned and build a solid foundation for your financial security.

Pay Off Outstanding Debts

One of the most effective ways to improve your financial situation is to pay off outstanding debts. Whether it’s student loans or credit card debt, taking steps to clear these debts can have long-term benefits. When prioritizing which debts to pay off first, focus on those with the highest interest rates. By doing so, you can save money on interest payments over time.

There are several debt repayment strategies that can help you efficiently tackle your debts. One strategy is the debt snowball method, where you start by paying off the smallest debts first, then move on to larger ones. This approach can provide a sense of accomplishment and motivation as you see your smaller debts disappear. Alternatively, you can use the debt avalanche method, which involves prioritizing debts based on their interest rates. By paying off the debt with the highest interest rate first, you can reduce your overall interest payments and pay off your debts faster.

- Start by paying off debts with the highest interest rates.

- Consider using the debt snowball or debt avalanche method to prioritize and tackle your debts.

- Make consistent payments towards your debts to gradually reduce the outstanding balances.

- Explore debt consolidation or refinancing options to potentially lower your interest rates.

By paying off your debts, you can free up more money for savings and other financial goals. It may take time and perseverance, but with dedication and the right strategies, you can become debt-free and achieve greater financial stability.

Interested in more? Check out our article The 7 Best Debt Payoff Strategies

Look for Deals and Discounts

Taking advantage of discounts and deals can help you save money on essential purchases. There are various ways you can find discounts, coupons, sales, and thrift stores that offer affordable items.

- Coupons: Look for coupons online or in-store to save money on groceries, clothing, and other items. Many retailers offer digital coupons that can be easily added to your loyalty card or mobile app.

- Sales: Keep an eye on weekly ads and promotional emails from your favorite stores. Taking advantage of seasonal sales, clearance events, and holiday discounts can save you a significant amount of money. Remember to compare prices and make informed purchasing decisions.

- Thrift Stores: Consider shopping at thrift stores or consignment shops for affordable items. From clothing and furniture to home decor and electronics, thrift stores often have a wide range of gently used items at discounted prices. You can find hidden gems and unique pieces without breaking the bank.

- Local Groups: Join local community groups or online forums where members share exclusive deals and discounted rates on services. These groups often provide valuable information about local sales, promotions, and special offers that can help you save money.

By actively seeking out deals and discounts, you can stretch your budget further and make the most of your money. Remember to plan your purchases, compare prices, and only buy what you need to avoid unnecessary expenses.

Find Additional Sources of Income

If you’ve cut your expenses and still need more income, there are various opportunities to explore. Consider taking on a side job or freelancing to supplement your earnings. Here are a few options to consider:

- Side Job: Look for part-time employment or gig work in your area that aligns with your skills and interests. Driving for ride-sharing services like Uber or Lyft can be a flexible and lucrative option.

- Freelancing: Leverage your skills and expertise to offer freelance services. You can provide online tutoring in subjects you excel in or offer your services as a freelance writer, graphic designer, or web developer.

- Selling Items Online: Take advantage of online marketplaces like eBay, Etsy, or Amazon to sell items you no longer need or create your own products to sell.

By diversifying your income streams through side jobs, freelancing, or selling items online, you can generate extra income and speed up your savings progress.

Comparison Shop for Insurance

When it comes to insurance, finding the best rates can make a significant difference in your budget. That’s why it’s worth taking the time to comparison shop for different insurance plans, whether it’s for car or homeowners insurance. I, personally, shop for new rates every two years to keep costs competitive.

- Research Insurance Rates: Start by researching different insurance providers and their rates. Look for companies that offer competitive prices and have a good reputation in the industry.

- Good Driving Record: Keep in mind that some insurance companies offer better deals if you have a good driving record. Safe driving habits can contribute to lower premiums and potential savings.

- Bundling Insurances: Another strategy to save money on insurance is to consider bundling your car and homeowners insurance with the same company. Many insurers offer discounts for bundling multiple policies, which can result in significant savings.

- Review Coverage Options: As you compare insurance plans, be sure to review the coverage options and understand what is included in each policy. Consider your specific needs and choose coverage that provides adequate protection for your car and home without unnecessary add-ons.

By taking the time to compare insurance rates and exploring different coverage options, you can find an insurance plan that fits your needs and budget. Remember, even small savings on insurance premiums can add up over time, helping you save money and protect your assets.

Reduce Food Expenses

Food expenses can quickly eat into your budget, especially if you frequently dine out. By making a few changes to how you approach meals, you can significantly reduce your food expenses and save money. In the last four years, I have saved significant amounts of money by cooking a majority of my meals. Here are some practical tips:

- Cook at Home: Instead of dining out or ordering takeout, try cooking meals at home. Not only is it more cost-effective, but it also allows you to control the ingredients and portion sizes, promoting healthier eating habits. Get creative with recipes and explore different cuisines to make cooking at home an enjoyable experience.

- Avoid Meal Delivery Kits: While meal delivery kits can offer convenience and variety, they can also be more expensive compared to buying ingredients and cooking from scratch. Consider skipping the meal delivery services and opt for planning and preparing meals on your own. This way, you have full control over what you buy and how much you spend.

- Track and Reduce Monthly Food Spending: It’s essential to have a clear understanding of your monthly food expenses. Take the time to track your grocery bills, dining out costs, and any additional food-related expenditures. This will help you identify areas where you can cut back or make more conscious choices. Look for alternatives to expensive ingredients, try meal planning to avoid food waste, and take advantage of sales and discounts at your local grocery store.

By prioritizing cooking at home and being mindful of your food expenses, you can make a significant impact on your overall budget. Not only will you save money, but you will also develop valuable cooking skills and enjoy healthier, homemade meals.

Cut Transportation Costs

Finding alternative transportation methods can save you money on gas and car-related expenses. By considering alternative modes of transportation, you can reduce your reliance on driving and save on transportation costs. If a store or even your work is within a reasonable distance that you can try alternative transportation, I strongly urge you to give it a try. I regularly ride my bike to the grocery store. Just remember to bring a bag or backpack for your goods! H

ere are a few options to help you cut your transportation expenses:

Biking and Walking

Consider biking or walking to nearby places instead of driving. Not only will this save you money on fuel and parking, but it will also benefit your health and the environment. Biking and walking are excellent forms of exercise and can help you stay fit while saving money on transportation.

Public Transportation

Utilizing public transportation is another cost-effective option. Public transportation, such as buses, subways, and trains, can be a convenient and affordable way to travel. By taking advantage of public transportation, you can avoid the costs associated with owning and maintaining a car.

Carpooling

Consider carpooling with coworkers, neighbors, or friends who travel in the same direction. Carpooling allows you to share the costs of fuel and parking, reducing your individual transportation expenses. It also reduces traffic congestion and contributes to a greener environment.

By implementing these transportation alternatives, you can significantly reduce your transportation expenses and save money. Whether it’s biking, walking, using public transportation, or carpooling, exploring these options not only helps you save money but also contributes to a more sustainable and eco-friendly lifestyle.

Conclusion

Saving money on a low income may require some lifestyle changes and adjustments. The truth is, to really save money, you are going to have to hustle. You are going to have to find some time, even if it’s ten minutes a week, to help implement some of the steps above. However, with the right strategies, it is possible to achieve your savings goals and improve your financial well-being.

One of the first steps is creating that dreaded budget. By carefully tracking your expenses and categorizing them as necessary or unnecessary, you can better understand where your money is going and identify areas for potential savings.

In addition to budgeting, it’s important to open a savings account. Whether you choose a traditional savings account or a high-yield savings account, having a dedicated place to save your money allows it to grow over time through interest.

Paying off outstanding debts, looking for deals and discounts, finding additional sources of income, and being mindful of expenses are all additional strategies that can greatly impact your ability to save money on a low income. Remember, every positive step you take towards financial stability is valuable, and consistent effort will yield significant results over time.