This article may contain affiliate links. See our disclaimer for more information.

Welcome to our comprehensive guide to help you get your budgeting finances in order. In the year 2024, it’s more important than ever to get yourself prepared for a more secure financial future. Whether you’re just getting started or have been budgeting for years, this guide will provide you with the tools and strategies you need to succeed. Read on to learn more about budgeting for financial success, the benefits of budgeting, creating a personal finance budget, tracking and managing expenses, long-term financial planning, maximizing income and minimizing expenses, utilizing budgeting tools and templates, overcoming common budgeting challenges, and revisiting and adjusting your budget. With our expert advice and guidance, you’ll be well on your way to achieving financial freedom and lifelong security. Let’s get started!

Learn to Budget for Financial Success

If you’re just starting out with setting up your budgeting finances, it can seem overwhelming. But don’t worry, we’re here to help! Learning to budget is a crucial step towards achieving financial success and stability.

First, make a list of all your monthly income and expenses. This will give you an idea of where your money is going and where you might be overspending. The next step is to set realistic goals for yourself so you can create a budget that fits your needs.

If you’re new to budgeting, it’s a good idea to start small. Try making incremental changes to your spending habits to avoid feeling overwhelmed. For example, you could try cutting back on eating out or entertainment expenses.

Remember, everyone’s budget will look different based on their lifestyle and income. Be sure to adjust your budget as necessary and don’t be too hard on yourself if you make mistakes. Budgeting takes practice, but the rewards are worth it.

Budgeting for beginners can be a daunting task. With these practical tips, you can learn to manage your money effectively and set yourself up for financial success.

The Benefits of Budgeting

Effective budgeting provides numerous benefits that can positively impact your financial planning. By keeping track of your expenses, you can make informed decisions about your finances. Here are some ways this helps:

- Reduces financial stress: A well-planned budget can help you avoid financial stress and anxiety by giving you a clear picture of your financial situation.

- Facilitates financial planning: Budgeting provides an excellent foundation for creating long-term financial plans and strategies.

- Helps you save money: Knowing where your money goes enables you to cut unnecessary expenses and save more money for the future.

- Assists with debt repayment: Budgeting can help you organize your debts and create a repayment plan that fits your budget.

By employing effective budgeting finances tips and strategies, you can achieve your financial goals and create a stable financial future.

Creating a Personal Finance Budget

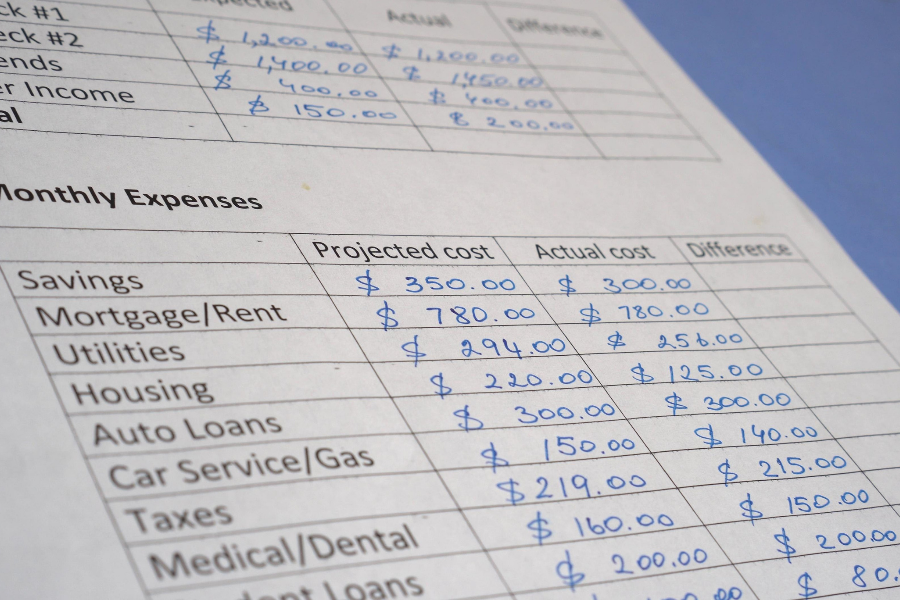

When it comes to financial planning, creating a personal finance budget is essential. Your budget should reflect your current financial situation and goals for the future. Let’s get started with budgeting finances. The first step is to determine your net income and expenses. Consider using budgeting tools that can help you track and analyze your spending patterns.

I recommend doing this for about a month until you have a clear picture of how much is actually going in and out. This way, you don’t have to backtrack and you’re not guessing.

Next you should identify your financial priorities and allocate your resources accordingly. You should aim to save at least 20% of your income and put aside some money for emergencies. Creating a budget also involves cutting back on unnecessary expenses and increasing your income through side hustles or negotiating a raise at work. If you can’t do 20% right now, it’s okay. Start with what you can and work your way up.

Remember, budgeting takes time and effort, but the rewards are worth it. By creating a personal finance budget and sticking to it, you can achieve financial stability and make progress towards your long-term financial goals.

Tracking and Managing Expenses

Effective money management starts with tracking and managing your expenses. By doing so, you can identify areas where you’re overspending and make adjustments to your budget as needed. The key is to keep track of all your expenses, big and small, and categorize them accordingly.

One useful budget planning tool is a spreadsheet or budgeting app that can help you keep track of your spending. For example, you can create a basic spreadsheet listing your monthly income and expenses, and analyze the totals to see where your money is going. Many budgeting finances tools even allow you to set limits for different categories, like food or entertainment, so you can stay on track and avoid overspending.

Another effective budgeting strategy is to use cash for certain expenses, like groceries or entertainment. By using cash, you can physically see how much money you have left to spend in a particular category, which can help you avoid overspending and stay within your budget. I did this method for almost two years. It helped me pay off my student loans and save for a down payment on my house!

Tracking and managing your expenses is an essential component of successful budgeting. With the right tools and strategies, you can stay on top of your finances and achieve your financial goals with ease.

Long-Term Financial Planning

When it comes to achieving financial stability, long-term planning is crucial. While budgeting strategies can help you stay on track from month to month, having a long-term plan is necessary to ensure your financial security for the future.

First, start by identifying your long-term financial goals. Whether you’re saving for retirement, planning for a child’s education, or hoping to buy a home, having a clear goal in mind will help you stay motivated and on track.

Next, evaluate your current financial situation and determine what steps you need to take to reach your goals. This may require cutting back on unnecessary expenses or increasing your income through additional work or investments.

Consider meeting with a financial advisor to help you create a long-term financial plan that takes into account your specific situation and goals. They can offer valuable insights and help you make informed decisions about investments and saving strategies.

Remember, long-term financial planning requires discipline and dedication, but the rewards are worth it. By identifying your goals, making a plan, and sticking to it, you can secure your future and enjoy financial freedom.

Maximizing Income and Minimizing Expenses

A good way to help with managing your budgeting finances effectively is to find ways to boost your income and reduce your expenses. Whether you’re looking to earn more money or simply save on daily expenditures, there are several tactics you can try.

- Consider getting a side job or freelancing opportunity to supplement your income

- Seek out discounts and deals when shopping for groceries, clothes, and other essentials

- Reduce your electricity bill by turning off lights and unplugging appliances when not in use

- Create a meal plan and cook at home to save money on eating out

- Cancel any unnecessary subscriptions or memberships that you may be paying for

Remember, every dollar counts when it comes to managing your budgeting finances. By maximizing your income and minimizing your expenses, you can stay on track with your budgeting goals and achieve financial stability.

Utilizing Budgeting Tools and Templates

Managing your finances can be a daunting task, but the good news is that there are plenty of budgeting tools and templates available to help you simplify the process. From mobile apps to printable forms, these tools can streamline your budget planning and make it easier to track your expenses.

One popular choice is online budgeting software. These programs allow you to create a budget, input your expenses, and monitor your progress all in one place. Some examples include RocketMoney, YNAB, and Personal Capital. With their user-friendly interfaces and real-time updates, these tools take the hassle out of budgeting.

If you prefer a more hands-on approach, there are also plenty of printable budgeting templates available online. These templates come in a variety of formats, including weekly, monthly, and yearly planners. They can help you visualize your budget and ensure that you stay on track with your goals.

When choosing a budgeting tool or template, be sure to consider your personal preferences and needs. Some tools may be more suited to certain types of budgets or financial situations. With a little research and experimentation, you can find the perfect tool to help you manage your finances effectively.

Overcoming Budgeting Challenges

While budgeting can provide tremendous benefits, it can also present some obstacles. Here are some common challenges people face when budgeting:

- Unexpected expenses

- Difficulty sticking to a budget

- Lack of motivation to continue budgeting

- Misunderstanding how to budget effectively

To overcome these challenges, try implementing the following budgeting tips and strategies:

- Always leave room in your budget for unexpected expenses.

- Be realistic about your spending habits and adjust your budget accordingly.

- Stay motivated by setting achievable financial goals and celebrating each success.

- Take the time to educate yourself on budgeting best practices to understand how they can work for you.

You can overcome your budgeting challenges and achieve financial success! Remember, budgeting is a process, and it’s okay to make mistakes. The key is to learn from them and keep moving forward with your financial planning.

Revisiting and Adjusting Your Budget

Budget planning is an essential part of financial planning, but it’s not a set-it-and-forget-it process. To ensure its effectiveness, you should regularly revisit and adjust your budget. Life changes, and so do your financial circumstances. Adjusting your budget accordingly will help you stay on track and reach your financial goals.

Set a regular date to review your budget, such as once a month or every quarter. During these reviews, track your expenses and income to ensure they still align with your budget. If you notice any discrepancies, adjust your budget accordingly.

Your budget should reflect your current financial situation and goals, so don’t be afraid to make changes as needed. It may take some trial and error to find the right balance, but the key is to remain flexible.

By revisiting and adjusting your budget regularly, you will be able to make smarter financial decisions and achieve long-term financial stability. Remember to incorporate budgeting tips and strategies throughout the process, and don’t hesitate to seek professional advice if needed.

Budgeting Tips:

- Regularly review your budget

- Track your expenses and income

- Adjust your budget to reflect changes

- Remain flexible

By following these budgeting tips and making necessary adjustments, you will be well on your way to financial success.

Conclusion

As we’ve discussed throughout this article, getting your budgeting finances in order is crucial for achieving financial freedom. Through effective budget planning, you can manage your money and set yourself up for long-term financial success.

Remember, learning to budget is a process that takes time and effort. But with the right strategies, tools, and mindset, you can overcome obstacles and reach your financial goals.

By maximizing your income, minimizing expenses, and utilizing budgeting tools and templates, you can stay on top of your finances and make informed decisions to secure your future.

Remember to regularly revisit and adjust your budget to ensure its effectiveness and flexibility. With persistence, dedication, and the right mindset, you can achieve financial freedom and enjoy a fulfilling, stress-free life.