If you read my first article, you’ll know that I need to revamp my budget. The budget I used pre-COVID, and subsequently gave up on, no longer works for me. For the last couple of months I tried to budget using my old method, but found myself going over in most spending categories, so I am buckling down and building a new budget.

Analyzing

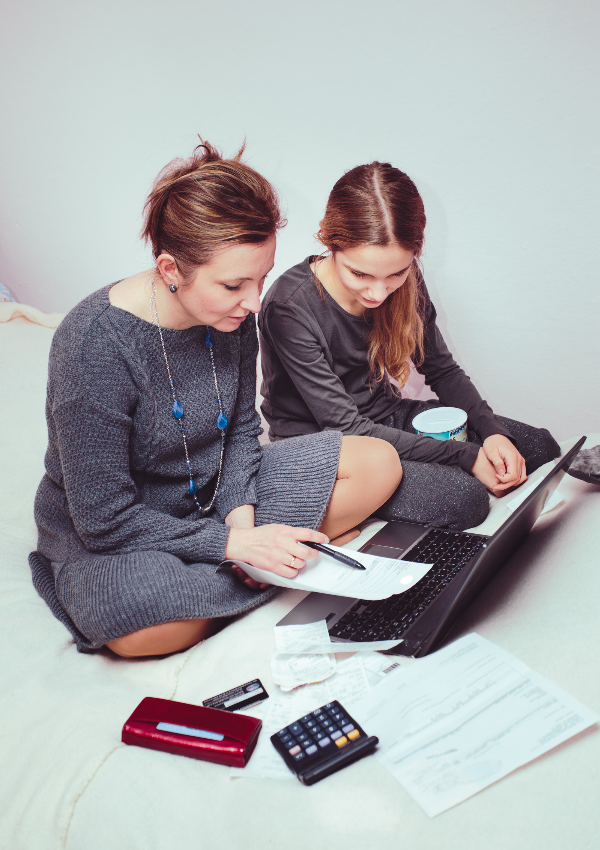

I spent several hours digging in and analyzing my finances. What was I spending on? What were my categories then vs. now? What are my priorities? I looked through credit card statements and tried to recall what I bought with cash. I logged in to every account so I could narrow down what I was spending on. You don’t have to go as deep as I did. Budgets can be general and still work great, but I needed to know, what had I spent so much money on?

Cutting Down

There is a big difference between being frugal and throwing money away. I had several items that were no longer needed. Here’s some things I reduced.

- Gym membership – I believe whole-heartedly in maintaining a certain standard of health, but the truth is, I was not using it. I have workout equipment at home and the gym closed early. The $24.99 I was spending a month is not worth it at this time.

- Grocery store reduction – I am spending quite a bit at the grocery store. $200 for one person per month is a lot in my opinion, and I have two freezers that are BOTH FULL. I should be able to reduce that significantly.

- Going out – This is probably where a lot of my money has gone. I have spent $450 to $600 a month just going out: Dinner with my boyfriend, drinks with friends. I’m going to try to reduce this category to $200 a month.

- Miscellaneous shopping – I spend on average $500 to $800 A MONTH on stuff, and I don’t even know what stuff it is. If I hadn’t been working so much overtime this would have put me in debt. Most of this spending was mindless. I’m going to try to cut this back to $100 a month and focus on being more cognizant of my spending.

Tools to Stay On Track

I am planning a big reduction in a couple of areas, so I am going to give myself some grace for the first few months. As long as I see a reduction, I’m on the right path. Here are some steps I am going to take to help with my budget:

- I logged in to any account that I could think of where I had saved credit card information and removed it. I then put a little sticky note on my cards that said, is it worth it? I am hoping this will make me hesitate and really analyze every purchase.

- I built a budget worksheet and plan to go over my finances weekly. As someone who hadn’t checked her accounts in months, this will be a big change, but if I want to have the life I dream of, regular check-ups need to happen. Once I’m on track, I’ll switch these to monthly.

- I got an app called My Money Pro. Unlike some apps that auto pull in your banking information, this one is all manual. You put in everything. Right now, this is what I need. I need to personally type in every purchase so I can determine how I feel about each one.

Items to Keep

I did not get rid of everything “unnecessary” from my budget. Like I’ve said, I want to continue to live my life. Here are some things I kept/added to my spending categories:

- $45 a month wine membership – I have a membership to one of my favorite wineries. Each month I get two bottles of wine sent to my door. It’s something I very much enjoy and use, so it is staying.

- TV subscription – My boyfriend and I enjoy winding down in front of the TV sometimes, so for the time being, I am going to keep my Hulu streaming service.

- The Bunny – I added a spending line for Jasper. Prior to my budgeting update, I did not have a spending line for my bunny, because I did not have him. I have added a new line to take care of this adorable little guy.

What Are You Doing?

Let me know what you’re doing with your budget. If you haven’t started one yet, what are you waiting for?