This article may contain affiliate links. See our disclaimer for more information.

Financial literacy is crucial for effectively managing your money and achieving your financial goals. Understanding concepts like budgeting, saving, and personal finance can help you to make informed decisions about your money. These financial literacy tips will allow you to take control of your finances and create a more secure financial future.

In this article, we will provide you with the best financial literacy tips to enhance your smart money management. Whether you are just starting your financial journey or looking to improve your current practices, these tips will help you navigate budgeting, saving, and personal finance like a pro.

Track Your Spending to Improve Your Finances

One of the first steps to financial literacy is tracking your spending. By keeping a close eye on where your money goes, you can gain valuable insights into your spending habits and make informed decisions to improve your finances.

A convenient way to track your expenses is by using a money management app. With the help of these apps, you can easily categorize your expenses, analyze spending patterns, and set budget goals. Popular money management apps like Mint, YNAB, and Personal Capital provide comprehensive overviews of your financial transactions, allowing you to streamline money tracking.

If you prefer a more hands-on approach, creating a spreadsheet with categories for different expenses can also be effective. By manually entering your expenses and regularly updating the spreadsheet, you can maintain a clear record of your spending and identify areas where you may be overspending.

Tracking your spending gives you valuable insight into where your money is going and helps you identify areas where you can cut back. For example, you might discover that a significant portion of your budget is being spent on dining out or entertainment. With this knowledge, you can make conscious choices to reduce those expenses and reallocate the saved funds towards savings or debt repayment.

Develop a Plan to Improve Your Spending Habits

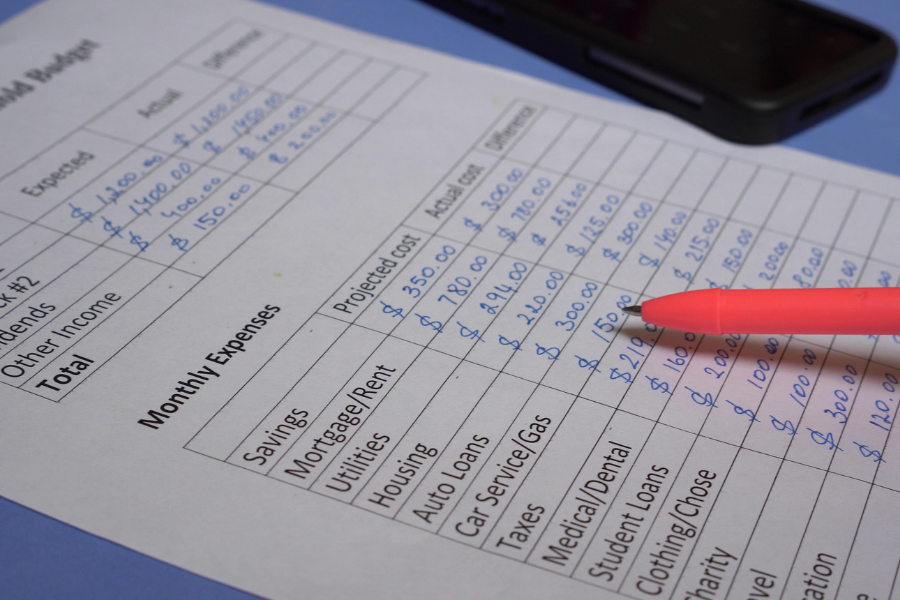

Once you have a clear idea of your spending habits, you can develop a plan to improve them. This plan should involve setting a monthly budget, allocating specific amounts to different categories, and monitoring your progress regularly.

Consider starting with small changes that are easier to implement and maintain. For example, try packing your lunch for work instead of eating out every day or opting for free or low-cost entertainment options instead of expensive outings. Most communities have fun, free activities around their towns. These small adjustments can add up over time and significantly impact your overall spending.

It’s important to remember that tracking your spending and working to improve your habits is a continuous process. Over time, your financial priorities may change, and your spending habits will need to be adjusted accordingly. Regularly review your progress and reassess your budget to ensure that your money management remains effective and aligned with your financial goals.

Create a Realistic Monthly Budget

Creating a realistic monthly budget is crucial for anyone who wants to get their finances in order. It allows you to gain a clear understanding of your financial situation and make informed decisions about your spending habits. By analyzing your monthly income and expenses, you can determine how much money you have available for saving, investing, and discretionary spending.

To create a monthly budget, start by calculating your total monthly income. This includes all sources of income, such as salary, freelance work, side hustles, and investment returns. Be sure to consider both fixed and variable income sources.

- Next, assess your monthly expenses. Categorize your expenses into essential and non-essential categories. Essential expenses include rent/mortgage payments, utilities, transportation, groceries, and healthcare. Non-essential expenses include dining out, entertainment, vacations, and shopping.

- Review your spending habits and identify areas where you can cut back. Are there any unnecessary subscriptions or memberships that you can cancel? Can you find more cost-effective alternatives for certain expenses? By making conscious choices, you can reduce your monthly expenses and free up more money for savings or debt repayment.

- Once you have a clear picture of your income and expenses, it’s time to set realistic financial goals. Determine how much money you want to save each month, whether it’s for an emergency fund, a down payment on a house, or a vacation. Set aside a portion of your income for these goals and prioritize your spending accordingly.

- Track your progress by reviewing your budget regularly. Make adjustments as needed to ensure that your budget remains realistic and aligned with your financial goals. Consider using budgeting apps or spreadsheets to help you stay organized and monitor your spending habits.

Remember, creating a realistic monthly budget is about finding a balance between your income and expenses. It’s important to be honest with yourself about your spending habits and make conscious choices that align with your financial goals. By following a budget, you can take control of your finances and work towards a more secure financial future.

Build Up Your Savings

Building up your savings is an essential part of financial security. One effective way to achieve this is by establishing an emergency fund. An emergency fund provides a financial safety net, allowing you to handle unexpected expenses without derailing your overall financial stability. By setting aside a portion of your income each month, you can gradually build up your emergency fund and gain peace of mind.

Regular savings contributions are key to growing your savings over time. Even small amounts can make a significant difference when consistently added to your savings account. Consider automating your savings contributions to make it easier and more convenient (that’s how I do it!)

Having substantial savings contributes to your overall financial security. It provides you with a sense of stability and resilience, allowing you to face unexpected challenges or seize new opportunities without relying on credit cards or loans. By prioritizing savings and consistently contributing to your emergency fund, you can strengthen your financial foundation and have a nice safety net to fall back on.

Get more savings tips with Creative Ways to Save Money

Pay Your Bills on Time

Paying your bills on time is a fundamental aspect of effective money management. By ensuring timely bill payment, you can avoid late fees, maintain your financial standing, and improve your credit score. On-time payment demonstrates your responsibility and reliability as a borrower, which can greatly benefit your financial wellness.

Bill payment is not only about avoiding late fees; it also allows you to prioritize essential spending. By paying your bills on time, you ensure that crucial expenses, such as rent, utilities, and insurance, are promptly taken care of. This proactive approach to financial management helps you maintain stability and avoid unnecessary disruptions in your daily life.

One of the best advantages of consistently making on-time payments is the positive impact it has on your credit score. Your credit score reflects your creditworthiness and plays a vital role in determining your access to credit, interest rates, and financial opportunities. By maintaining a strong on-time payment history, you demonstrate to lenders and financial institutions that you are a responsible borrower, which can open doors for better interest rates, improved loan terms, and increased financial flexibility.

To ensure you never miss a payment deadline, consider setting up automatic payments or creating reminders on your calendar or smartphone. This proactive approach can help you stay organized and avoid any financial setbacks due to late payments and fees.

Cut Back on Recurring Charges

When it comes to managing your finances, it’s important to review your monthly expenses and identify subscriptions or recurring charges that you don’t regularly use or need. These unnecessary expenses can quickly add up and create unnecessary financial strain.

By taking the time to analyze your recurring charges, you can free up more money each month and improve your overall financial situation. Canceling subscriptions that you don’t actively use will not only save you money but also help you make better decisions about where to allocate your funds.

Start by making a list of all the subscriptions and recurring charges you have, such as streaming services, gym memberships, or monthly service fees. Evaluate each item on your list and consider whether you truly need or use them on a regular basis. Be honest with yourself and don’t hold onto subscriptions simply out of habit.

Once you’ve identified the unnecessary expenses, take action to cancel them. This may involve contacting customer service, navigating online account settings, or utilizing cancellation apps that simplify the process. Remember to keep track of the cancellation confirmation for your records.

By being mindful of your recurring charges, you can take control of your spending and make better financial decisions. Cutting back on unnecessary expenses is a simple yet effective way to free up more money each month and improve your financial well-being. Not only are you saving money every month, but your monthly expenses will go down as well, meaning you will need less income to live on.

Save up Cash for Big Purchases

When it comes to making major purchases, it’s always wise to save up cash instead of relying on loans or credit cards. By opting for cash purchases, you can avoid the burden of debt and interest payments, allowing you to keep your finances in check and enhance your overall financial resilience. It can also give you some leverage when buying big ticket items and make it easier to stay within your budget.

By saving up for big purchases, you are taking a proactive approach to managing your finances. Instead of being tied down by monthly payments and accumulating debt, you are actively working towards strengthening your financial position.

Furthermore, saving up cash gives you an opportunity to accumulate interest on your saved money. By keeping your funds in a high-yield savings account, for example, you can earn interest over time, rather than giving that interest to someone else.

Benefits of Cash Purchases:

- Avoidance of interest payments and debt accumulation

- Strengthened financial resilience and stability

- Opportunity to accumulate interest on saved money

When planning for major purchases, consider creating a separate savings account specifically for that purpose. Allocate a portion of your monthly income towards this account, ensuring that you are consistently working towards your goal. By setting a realistic timeframe and saving strategy, you can make the purchase without any financial strain or added stress.

Remember, financial resilience is all about making informed decisions and taking control of your finances. By prioritizing cash purchases and actively saving for big expenses, you are building a solid foundation for your financial future.

Start an Investment Strategy

Even with limited resources, starting an investment strategy can help you grow your wealth over time. There is a reason why everyone says to start early. Instead of letting your money sit idle in a regular savings account, consider exploring investment opportunities that can provide financial growth and security.

One option to consider is opening an investment account specifically tailored for retirement planning. These accounts, such as Individual Retirement Accounts (IRAs) or 401(k)s, offer tax advantages that can help your money grow faster. By contributing regularly and taking advantage of employer-matching programs, you can maximize your investments and set yourself up for a comfortable retirement.

Take advantage of compound interest by starting early and making regular contributions to your retirement account. This will allow your invested money to grow exponentially over time, ensuring a healthier financial future for yourself.

Aside from retirement accounts, there are various other investment opportunities available to you. Consider diversifying your portfolio by investing in stocks, bonds, mutual funds, or real estate. Research different investment options to find ones that align with your risk tolerance and financial goals.

Remember, investing is a long-term strategy, and it’s important to be patient and stay committed. While there may be ups and downs in the market in the short term, historically, investments have provided substantial returns over the long run.

Automating your investments can also be a smart move. Set up automatic contributions to your investment accounts, so you don’t have to worry about manually transferring money each month. This ensures that you consistently invest and take advantage of any dollar-cost averaging opportunities that may arise.

By starting an investment strategy, you can use your earned money to generate more income and work towards your financial goals. Whether it’s saving for retirement or achieving financial growth, investing is a powerful tool that can help you build a brighter financial future.

Conclusion

Financial literacy is the foundation for smart money management and achieving financial goals. By implementing the best financial literacy tips, individuals can take control of their finances and create a more secure financial future.

One of the key aspects of financial literacy is tracking spending. By monitoring expenses and identifying areas where you can cut back, you can improve your money management and develop a plan to achieve your financial goals. Creating a realistic monthly budget is also crucial in prioritizing your spending and making conscious choices to improve your financial situation.

Building up your savings and establishing an emergency fund are important steps towards financial security. By making regular contributions, even small amounts, you can create a financial cushion for unexpected expenses and achieve greater financial resilience.

Paying bills on time and cutting back on unnecessary recurring charges can also have a significant impact on your financial well-being. By maintaining a strong payment history and being mindful of expenses, you can improve your credit score and free up more money for other financial priorities.

Finally, starting an investment strategy is a key component of financial literacy. By exploring investment accounts and taking advantage of employer-matching programs, you can grow your wealth over time and work towards a more prosperous future.

To achieve financial goals, it is essential to have a solid foundation in financial literacy and implement smart money management strategies. With dedication and commitment to improving money management skills, anyone can take control of their finances and create a better financial future.