Okay, why is it so hard to save? You know what I’m talking about. No matter what goals you make or times you try your savings account is always empty?

I’m sure I could do a psychological deep dive and explain exactly what happens in our brains that prevents us from saving, but I think we all know the usual culprits.

They vary person by person, but some of the most common reasons are:

- Overspending

- Not making enough money

- Lack of willpower

- Not having the right systems to know how.

The number one cause in my own life? Over-spending. Now, I don’t overspend to the point where I go into debt. I’m good about that at least, but it seems like every time I pick up an extra shift or get some unexpected cash, I use it as an excuse to buy something I want.

Case and point. I just received my NYS STAR check for a little over $500. I have some savings goals for the next year and I need to get a new sink top since the porcelain of mine cracked. Do you know what I did with that check? Spent almost all of it and saved $100 of it.

Only $100. How sad is that. I could have given my savings account a $500 boost or done a little repair, but no. I went straight to my wish list and bought several items that, while I do want them, I definitely don’t need.

So what can we do about this? Here’s some steps I’m personally taking to be a better saver:

Automated Savings

I’ve actually been doing this for a couple of years, but recently I’m trying to ramp it up. I created several separate checking accounts and changed my direct deposit with my employer to automatically put money into those accounts. This way, the money never hits my checking account, but is deposited directly to savings. Here are some savings accounts I have:

- Vacation fund

- Emergency fund

- Car insurance fund

- Rainy day fund

- Investing fund

- Future car/car maintenance fund

I have to tell you, the automation has been a life saver. When I’m ready to plan a vacation, I just log into my account, and so far I’ve always had more than enough to cover my plans. Just this month my car insurance was due, and the account had more than enough money to pay in full.

So why does automated saving work so well? Because after the initial setup, it’s mindless. I’m not saying everyone has to have multiple accounts like I do, but I would highly recommend having at least one separate High Yield Savings Account (HYSA) to grow your savings in.

Automated savings take the work out of saving. Once you have the deposit or transfer set up, the money grows mindlessly. No more transferring out amounts and questioning if there is enough in your checking account. Automated savings takes out all of the guess work and helps your money grow with minimal effort from you.

If you’re looking for tips to help automate your savings, check our article here.

Learning

If we don’t learn, we don’t grow. Another step I’m taking towards savings is learning. I am constantly reading, listening, and absorbing as much as I can about finances is general, which has gone a long way toward helping me with my financial goals.

Until a few years ago, I had never heard of a HYSA. The rate of interest on these accounts is significantly higher than regular savings accounts, so for years I was missing out on interest income. Until several years ago, I had two savings accounts. Now that I understand sinking funds and the importance of automated savings for my own financial picture, my savings have grown that much faster.

What are sinking funds, you may ask? Sinking funds are when you set aside small amounts to save for a known, planned future expense. For example, say your car insurance is $1400 a year. If you divide by 12, you need to save $117 per month. Doesn’t that sound much better than trying to find $1400? Or worse, putting that $1400 on a credit card and then having to pay interest?

I set aside about $80 a check, or $160 a month to a sinking fund specifically for car insurance. The extra amount gives me a little bit of a buffer, and when the bill comes do, paying it is stress free.

Learning different ways to save, and how others do it can be both informative and motivational. If you’re not sure where to start, I highly recommend checking out your favorite platform (YouTube, Instagram, etc.) and learning how others save. Trust me, it’ll go a long way with helping you save your own money.

Building Savings into a Budget

One important thing I did was build savings into my budget. Those sinking funds would have never worked if I did not have enough money left to pay my bills at the end. By creating a budget that prioritized savings, I was able to determine exactly how much I could allocate toward each savings account without sacrificing my needs and wants.

Building a budget that prioritizes savings isn’t hard but may require sacrifice. If you don’t currently have any income left over after paying your expenses, you may have to change around your priorities. Could you order out a few times less a month to put some money toward savings? Is it time to start budget shopping?

If you do have some wiggle room, then creating savings goals should be easy! Calculate how much of your extra income you would like to allocate towards each savings goal, and then make it happen! Those accounts will grow before you know it!

The Savings Snowball Method

Another method I have been using to help me save has been the savings snowball method. If you have been learning about finance at all, you have probably heard of the debt snowball method. With this, you pay off your smallest loan first, then allocate the money that was paying off that loan to the next one, so on and so forth until your debt is gone.

The same thing can work for savings! For each of my savings goals, I decided on a final amount. Once an account reaches that goal, I stop contributing savings towards it and start allocating the money I was giving toward that goal to another, helping the account grow that much quicker.

Here’s an example:

Let’s say I have three savings goals: an emergency fund, a vacation fund, and a new phone fund. I will set a goal for each account: Emergency fund – $10,000. Vacation fund – $3,000. New phone fund – $600.

Let’s say I have an extra $300 to save a month. I decide to contribute $100 each month to each fund. At the end of six months I will have $600 in my new phone fund. Instead of allowing the $100 back into my spending budget, I instead decide to add it to the vacation fund. I am now putting $100 towards the emergency fund, and $200 towards the vacation fund, meaning the vacation fund will grow twice as fast. Once that is full, I can allocate $300 per month to the Emergency fund, helping that one grow three times faster.

Do you see how it works? This has helped me fully fund three of my savings funds in the last year, and put a significant amount towards my other savings. If I use some of the funds from a full fund, such as my vacation fund, I merely switch some of the allocated savings money back to that account until it is full again.

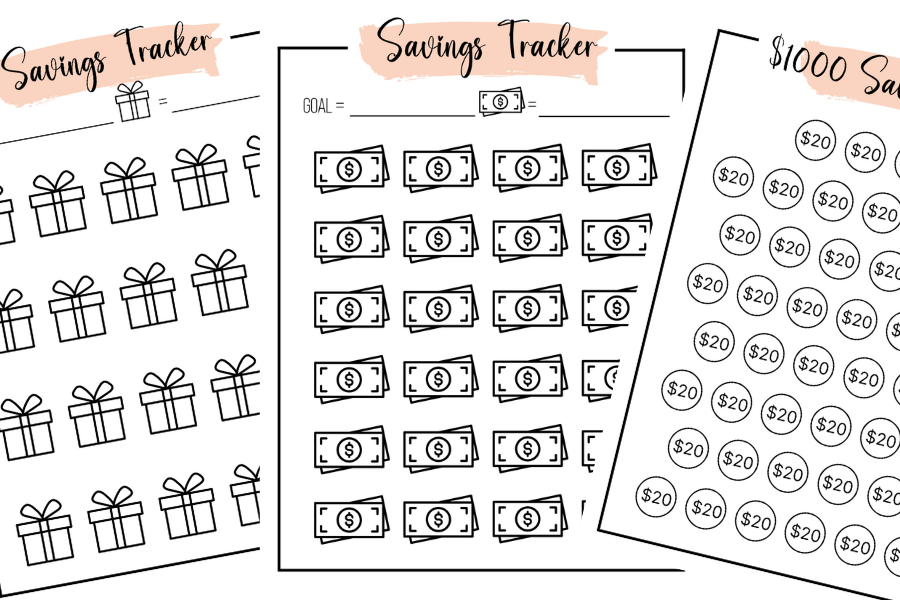

Savings Trackers

One of my favorite (and most fun) ways I’ve found to help me save have been the use of savings trackers. Everyone is motivated in different ways, and one way I have found works for me is the use of savings trackers.

A visual savings tracker can come in many forms. I usually use print outs or pages in my Rocketbook Journal to keep track. There are many different trackers out there, but they all follow the same general idea: there is some way to mark off saved amounts so you can see your progress toward your final goal.

Hint: this works great for debt payoff as well.

Last year I wanted to save $500, as my sisters and I were planning on giving my parents some extra money to help my dad retire. How did I do it? If you guessed “by using a savings tracker,” you would be right! I used the exact tracker pictured below to slowly save my available cash and over the course of about eight months, was able to save up the $500. I’m going to be doing the same thing next year!

As you can see in the tracker, each time a certain amount was paid off, I would fill in the bubbles with how much I put in my savings envelope. This always encouraged me to save more, because I loved filling in the bubbles and watching my progress. Especially as I got closer to the end, it became more and more motivating to find extra cash to put toward this savings fund.

Conclusion

What motivates you? Is it a visual aid? Is it the encouragement of family and friends? Whatever it is, find your motivation and use it to your advantage to save! Maybe you need to get your spouse on board as a cheerleader, or you want to build savings into your budget. All of these things are achievable!

There are many different ways to save, but I honestly think automated savings might be my favorite, and possible the best. The set it and forget it concept behind these has helped me save thousands over the years. Sometimes I log into my accounts and am surprised by how much is in there.

Saving can be extremely difficult. It feels so easy to spend our hard earned cash, but by implementing some of the tips above, we can make saving easier and more fund. Just imagine the satisfaction of having a fully funded vacation fund, and get started on your savings journey today!